Understanding construction loans is an essential piece of the building process.

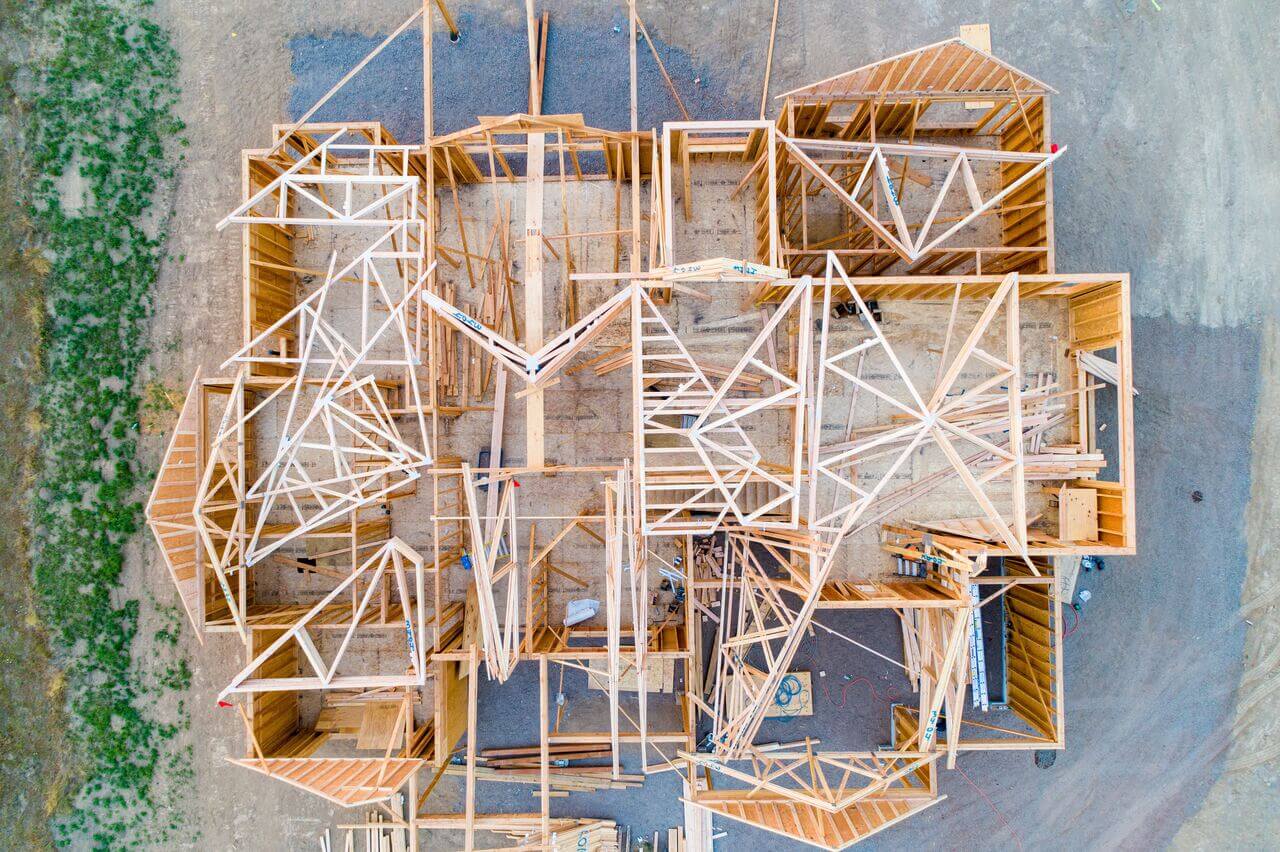

Let’s say a client hires a contractor to build them a house.

Aside from a downpayment, the client doesn’t pay for the house until it’s built.

The contractor can’t build a house on a downpayment alone. He obtains funds through a construction loan to cover the costs of materials and labor.

What is a Construction Loan?

Unlike a mortgage loan, a construction loan is short-term. A construction loan covers the cost of a construction project from start to finish. General contractors use construction loans to purchase materials and pay subcontractors for their work on the project.

Risk. It’s what makes construction loans so complex. The collateral for the loan is the house, building, or construction project that has yet to be completed. Where there is risk, there is mitigation. Lenders mitigate the risks of construction loans by charging higher interest rates. In 2020, the average interest rate for a construction loan was 4.5% [The Mortgage Reports].

Types of Construction Loans

Part of understanding construction loans is knowing the different types available. There are three types of construction loans:

● A construction-to-permanent loan covers the construction costs and the finished home. It starts out as a higher adjustable-rate construction loan and converts to a lower, fixed-rate permanent mortgage once the home is complete.

● A construction-only loan is a short-term high-interest-rate loan that is used only to complete the project. These loans usually have a life of 12 months or less [Investopedia]. Once the project is finished, the loan is either paid in full or refinanced.

● An owner-builder loan is difficult to obtain. These loans are for homeowners who also want to act as general contractors to build their own homes. It’s typical for lenders to require a 20-25% downpayment to obtain an owner-builder loan [Scotsman Guide].

The Draw Process

Construction loans aren’t issued in a lump sum. Instead, they are issued through a series of installments throughout the building process. These installments are known as draws. A draw schedule is created based on the project timeline at loan origination.

Lenders often send inspectors to make sure the project is going according to plan. If the inspector isn’t satisfied, the draw schedule is adjusted.

The draw process might seem inconvenient, but it’s a great way to save money on interest. The contractor only pays interest on the amount they’ve drawn instead of on the total sum of the loan. Who wouldn’t mind saving a little extra money on interest?

CoFi Makes the Construction Loan and Payment Process Easier

Understanding construction loans makes the construction process more manageable. So does CoFi. Extensive paperwork and labor-intensive spreadsheets are a part of the past. Let CoFi move you into the age of technology.

Whether you’re a lender or a contractor, CoFi can help your business become more efficient. See for yourself how our platform can work for you. Contact us today to schedule your personalized demo!